Irredeemable Convertible Preference Shares

Specific requirements as to particulars in prospectus 27 ii 38. In case of partly convertible debentures the debenture-holders are paid for a fixed part and for the balance part of the debenture the convertible part they are issued equity or preference shares.

What Is Irredeemable Convertible Preference Share Youtube

The following procedure is to be followed for Issue of Convertible Preference Shares on Preferential basis by a Company limited by Shares under Section 42 55 62 Rule No.

. However Preference shares could be converted into equity shares. This will be the case when eg. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position.

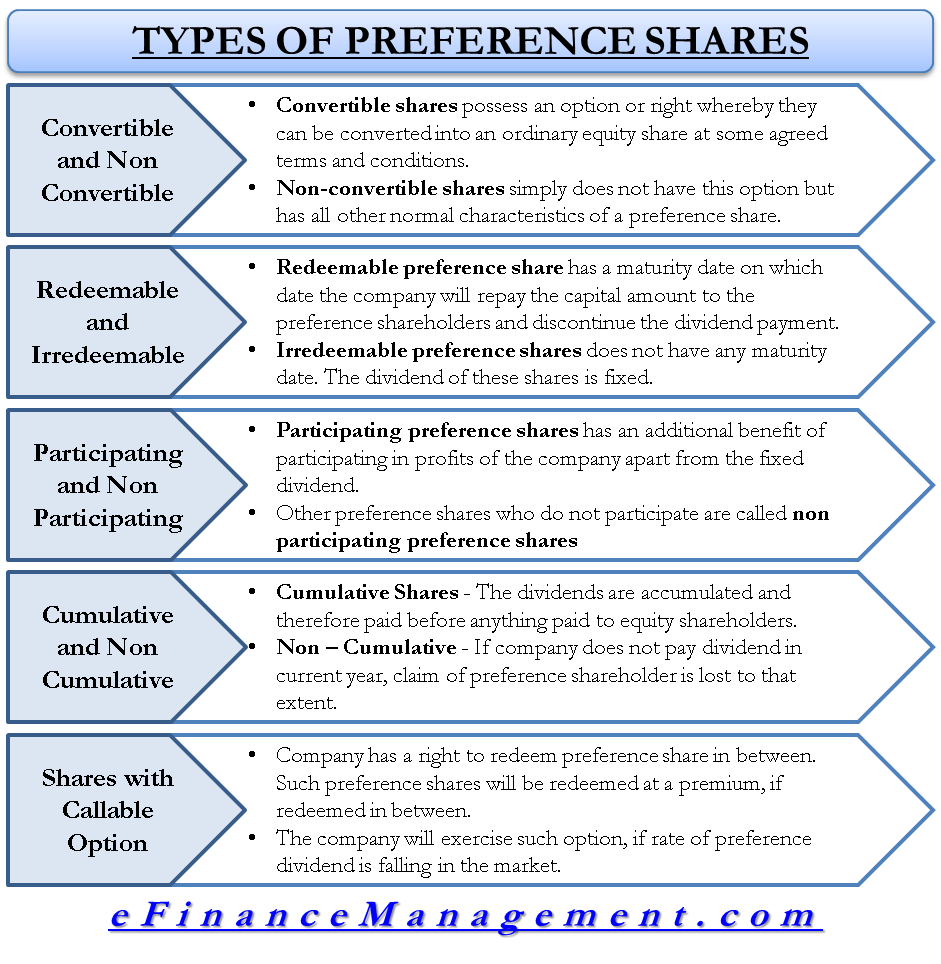

On our forum we also discussed irredeemable cumulative preference shares. These types of shares are sans any maturity date. These preference shares can only be redeemed if the company shuts its operations or liquidates itself.

Irredeemable or redeemable only on the happening of a contingency however remote or on the expiration of the period however long. Experts consent to issue of prospectus containing. Classification is based on an assessment of the substance of the contractual arrangement and the definitions of a financial liability and an equity instrument.

To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable. Debentures are backed only by the general creditworthiness and reputation of the issuer. Diff --git acoreassetsvendorzxcvbnzxcvbn-asyncjs bcoreassetsvendorzxcvbnzxcvbn-asyncjs new file mode 100644 index 0000000404944d --- devnull b.

To elaborate shareholders will have to wait until the company decides to wind up its current operations or liquidate the venture altogether to initiate the same. PART IV SHARES AND DEBENTURES PROSPECTUS 36. Equity shares cannot be converted into preference shares.

1 preference share can be converted to 1 ordinary share at any time. This particular share cannot be redeemed or repaid during the active lifetime of a company. The shares which carry voting rights on which the rate of dividend is not fixed.

A debenture is a type of debt instrument that is not secured by physical assets or collateral. Further no company can issue irredeemable preference shares. ICPS holders cannot redeem and convert as they please.

The definition of shares or other securities does not include non-convertible Preference Shares. Fully convertible debentures are redeemed by issuing equity or preference shares instead of making any payment. Equity shares are irredeemable but preference shares are redeemable.

These types of. Here shareholders are allowed to convert their preference shares into common equity shares. In general equity shares carry the right to vote although preference shares do not carry voting.

14 of the Companies Prospectus and Allotment of Securities Rules 2014 -. Preference Shares The shares which do not carry voting rights but the rate of dividend is fixed. This can be done after a certain time period and at a certain conversion ratio.

This is an interesting fact that although they. A company can repurchase or claim redeemable preference share at a fixed price and time. So a few details first for Sunways irredeemable convertible preference shares ICPS.

Such preference shares are non-redeemable but come with mandatory fixed dividends that are below market rate. Enter the email address you signed up with and well email you a reset link. The next major difference is the right to vote.

Item 1 paragraph aFor example a State or Territory provision enacted after the commencement of the Corporations Law might not have operated despite the Corporations Law if it was not expressly provided that the provision was to operate despite a specified. In the event of winding up of the company equity shares are repaid after the payment of all the liabilities. This ratio is pre-determined.

Case-2- Preference shares are non- redeemable- When preference shares are non- redeemable the appropriate classification is determined by the other rights that attach to them. As per above 50 will be converted to Sunway ordinary shares on year 4 remaining on year 5. Rule 9 of the Companies Share Capital and Debentures Rules 2014 are the relevant rule under section 55 which lay down conditions for issue and redemption of preference shares.

The conclusion was that cumulative preference shares where the contractual obligation to pay dividends arises on liquidation. They are irredeemable in nature. Irredeemable Preference Shares.

9 10 13 of the Companies Share Capital and Debentures Rules 2014 and Rule No. Item 1subsection 12 tells you when a provision is a precommencement commenced provision.

Callable Preferred Stock Preferred Stock Financial Statement Analysis Accounting Principles

What Is Irredeemable Convertible Preference Share Youtube

0 Response to "Irredeemable Convertible Preference Shares"

Post a Comment